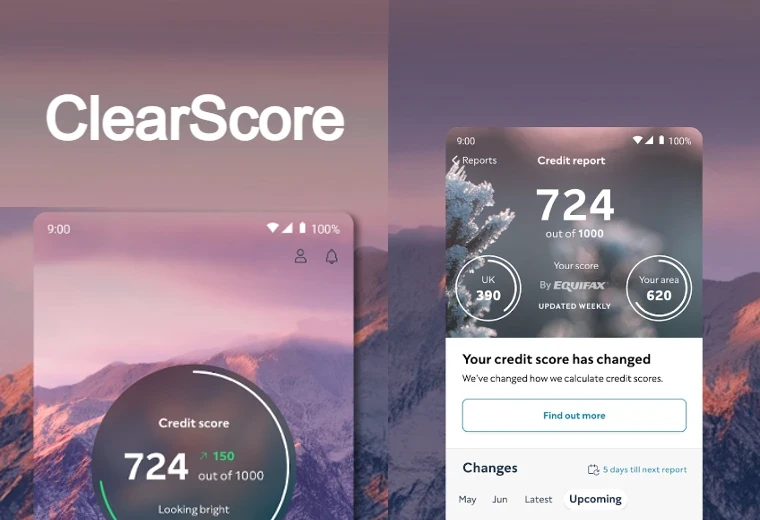

ClearScore Australia Review In 2024

Sometimes, applying for credit can be intimidating. Keep reading to learn more about this online service to determine your credit score.

What is ClearScore?

ClearScore is an online service that gives you access to your Equifax credit score. It also lets you see how you look to lenders and banks. Equifax is one of three credit reporting agencies located in Australia. Lenders send Equifax information about your credit and how it’s managed to create a complete credit report.

ClearScore, a UK-based fintech, also has arms in South Africa. ClearScore launched in Australia in 2020. It allows Australians to access their credit scores and report free of charge using ClearScore’s website, Android, and iOS apps.

Experian credit information is used by the fintech. It stated that it wants to “play an important role in Australia’s credit landscape in light of the financial service royal commission”, especially as the royal commission “showed just how important it was for Australians to understand credit and lending”.

ClearScore is an entirely free service. However, ClearScore does make a profit from the advertising of banks and other financial institutions. ClearScore receives a commission if you decide to buy a financial product recommended by ClearScore.

It also provides a platform for Australians to search for deals on personal loans, credit cards, and home loans.

What are the ClearScore Services?

ClearScore can give you a credit score based on the information from your credit report. This information can be used to assess your financial situation and to help lenders determine if you are eligible for credit cards or loans.

ClearScore’s online service is free and you can:

- Access your credit score

- Your credit report will show you where your finances are

- Find out what is behind your credit score

- For signs of fraud, check your credit report

- Dark web monitoring can help you determine if your passwords were stolen

How to Improve your Score at ClearScore?

Your next thought may be how to improve your credit score. ClearScore will give you insight into your credit history, including what could be affecting it and how to improve it.

ClearScore says these are the factors that can either positively or negatively affect your score.

Factors that can positively affect your score:

- Excellent repayment history

- Low number of credit inquiries

- Stable address

- There are no negative entries on credit reports (e.g. missed payments, defaults, court judgments or bankruptcy)

Factors that could negatively impact your score:

- Payday lenders are a good example of short-term credit

- In a very short time, there are many credit inquiries

- Defaults, bankruptcy actions and missed payments, or court judgments

- Opening accounts with debt collection agencies

ClearScore Credit Check: How to Get One?

ClearScore will verify your identity by requesting a form such as a passport or driver’s licence. This security measure is to ensure that only you have access to your credit score and credit report.

ClearScore will securely retrieve Experian credit data and give you your credit score once your identity has been verified.

What are the ClearScore Credit Ratings?

ClearScore is a score that helps lenders determine whether or not to grant you credit. Higher scores mean that your application is more likely to be accepted. You may also qualify for lower interest rates, whether you borrow money or take out a loan.

ClearScore helps you determine your credit score. It categorizes your credit score into one or more of five bands. These range from “Soaring high”, for those with the highest scores, to “Raise your game”, for those who need improvement.

These are the ratings for each credit score range:

- 800-1,000: Soaring high

- 700-799: Looking Bright

- 625-699: On good ground

- 550-624: On the up

- 0-549: Raise your game

Conclusion

This is a fantastic service that’s completely free. You can check your credit score in your local area or state. It is easy to find low-interest loans that they offer and saves you a lot of time.

It is a wonderful tool to help you manage your credit score. It’s a great tool to have so that you can maintain your credit rating. It is great to see your credit rating improve, and it is something that we should all be concerned about.