Wealth Management In The Digital Age: How To Master Your Money

Everybody wants to be financially secure, but it can be a daily struggle to just make ends meet, let alone accumulate wealth. However, setting strong wealth management strategies could help you build your finances up incrementally.

One of the greatest myths in the financial world is that wealth management is only for the wealthy. Instead, wealth management can play a crucial role in attaining, increasing, and safeguarding one’s financial prosperity. But this is not just the domain of the rich and famous. By adopting a robust wealth management strategy, anybody could potentially attain a comfortable and stable standard of financial security.

The primary goal of wealth management is to enhance wealth, guarantee financial stability, and safeguard assets for the benefit of future generations. Of course, this has grown more complicated over the years thanks to digital advancements, currencies and tools to manage wealth.

This article aims to simplify the wealth management process for you, boil it down to straightforward steps and teach you how to gain control of your finances, even in the face of a tough economic outlook.

Budgeting in the Digital Age: Think Smart

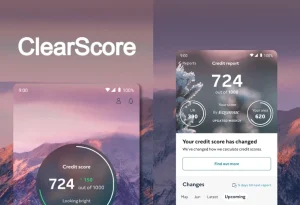

Budgeting is the cornerstone of all wealth management, but it can be very overwhelming for a lot of people. Simple spreadsheets no longer cut the mustard with so many different expenses and digital payments, so it is essential to lean into those same modern innovations to create useful and easy to follow budget plans.

The official Australian Securities and Investments Commission’s (ASIC) MoneySmart Budget Planner is a great place to get started and there are a number of privately owned apps available as well like Pocketbook that can track your spendings, help you achieve your goals and deliver real-time updates to show you are on the right track.

Comparing Credit Cards: Understanding These Finance Assets

Using a suitable credit card to support your personal spending can actually be one of the easiest ways to manage your money, with immediate benefits. Many people don’t think to compare credit cards, sticking with the brand and bank that they are comfortable with whilst remaining unaware of the savings they could make by switching.

When comparing credit cards, consider the following.

The ongoing purchase rate

Ensure you check the full interest rate before applying for any card offer. Interest rates may impact consumers if they’re unable to pay their card balance back on time, so it’s imperative that you take purchase rates into account when comparing credit card offers.

Interest free days

This is the number of days you won’t get charged interest for your purchases. If you can pay off the debts before this period of time elapses, you will be financially better off.

Assess card fees

Some banks or lenders charge monthly, some annually. Ensure you are getting the best deal. Also look for any other hidden fees including late repayment, cash advance, credit limit and overseas purchasing fees. They won’t all be relevant, so consider your situation.

Assess rewards programs

This can come in the form of cheaper groceries, travel rewards, discounts with partner brands or more. Ask yourself which financial institute offers the best rewards, and also the ones that are most beneficial for you.

Superannuation: Planning for the Future

It can really pay to take more control over your superannuation to ensure your financial future. While 68% of Aussies have at least one super account with an additional 6 per cent looking to join their ranks, this is still a staggering amount of people who will find themselves caught short in retirement.

Over 4.5 million Aussies fear they might be forced to work past their retirement age because they don’t have enough super, so the time to take control is now. The advent of platforms such as MySuper has revolutionised how Australians interact with their super funds. These platforms provide a straightforward way to compare various super funds, focusing on their performance, associated fees, and the range of investment options available. By diving into the details of their superannuation early and making well-informed choices, Australians can significantly bolster their financial stability for the future.

Protecting Your Wealth: Insurance and Security

In days gone by, your money was always safe in the bank. We live in a different world now, though, and cybercrime is a very real threat that can result in a total financial wipeout. Over ⅓ of Australians have reported being impacted by cybercrime in some form during their lifetime, which is a sobering statistic that should not be ignored.

So how can one avoid being a victim of a hacker? There are some simple steps you can follow. Ensure all of your important apps, accounts and email logins are protected by two-factor authentication, only use secure Wi-Fi connections, and use strong, unique passwords for all financial accounts.

Considering insurance is always advisable as well, just in case the worst case scenario happens. This can cover cybercrime, but also other non-planned events like sudden death, permanent disability or other circumstances beyond your control.

Staying Informed: Continuous Learning

The financial landscape is continually evolving, making it essential to stay informed about the latest trends, tools, and regulations. Australian financial news sites, podcasts, and blogs can provide valuable insights and updates. Engaging with professional financial advisors who understand the intricacies of the Australian financial system can also offer personalised guidance tailored to your specific needs.

Wealth management in the digital age presents both opportunities and challenges for Australians. By leveraging digital tools to compare financial products, budget, invest, and plan for the future, while staying informed and vigilant about security, individuals can take control of their financial destinies.

Remember, the key to mastering your money in the digital era is not just about embracing new technologies – but using them wisely to make informed, strategic financial decisions.